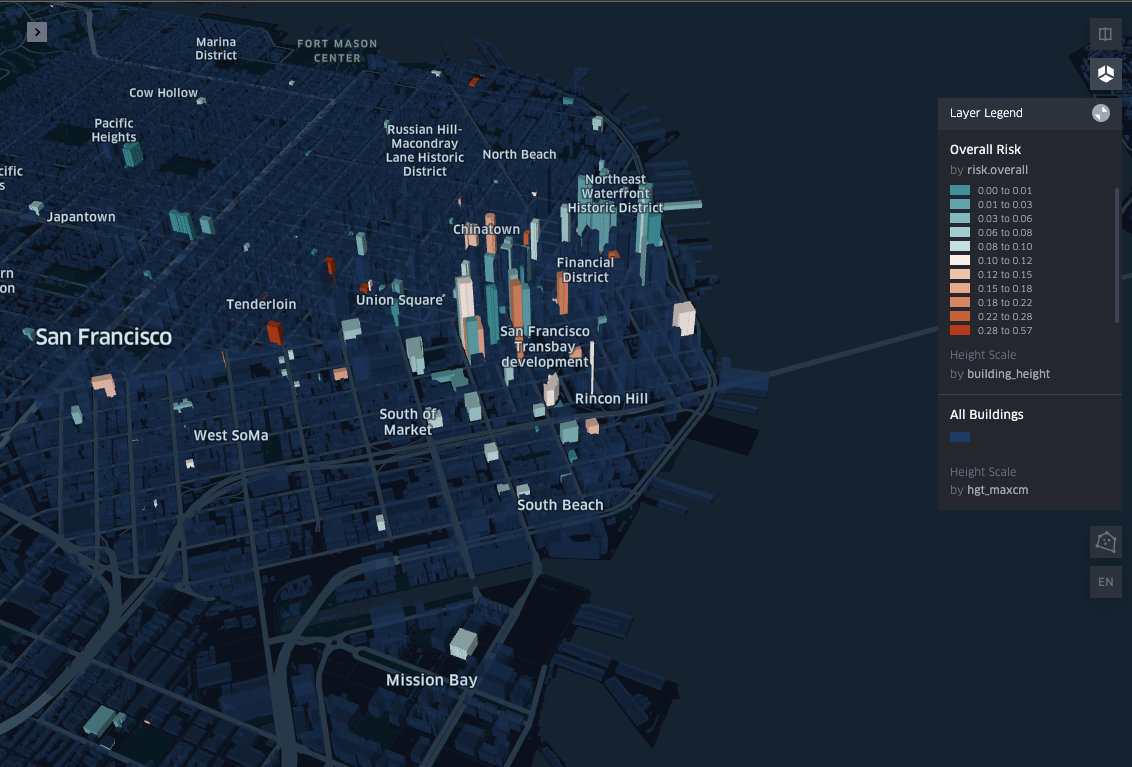

The results of our analysis are presented below. Here you can interact with a selection of properties across San Francisco. If you hover over the graphic, you’ll find an assortment of descriptive information, including the property’s address, the name of the business that occupies the property, and risk scores computed according to each of the following categories:

- Financial Risk: Assessing the tenant’s financial well-being as well as broader economic factors such as interest rates, GDP growth, and sector employment trends.

- Sentiment Risk: Evaluating sentiment and perception related to the property and tenant.

- Geographic Risk: Considering geography-specific risks like local crime, as well as weather events, earthquakes, etc.

- Tenant/Site Risk: Analyzing tenant history, including payment reliability and tenure.

- Overall Risk: A weighted composite score of the above metrics.

Each of these risk scores falls between 0 and 1, where the risk score is intended to communicate the likelihood that a given tenant/property will default. The higher-risk properties are indicated by a darker shade of red, while relatively safe properties are represented with green, with varying shades of yellow covering the properties in between.